You can now get your free credit score in South Africa without paying a single cent. A credit score is an important thing that can make life easy for you or very difficult. It will follow you around for a very long time if mismanaged. It is therefore very important to keep track of your credit rating and manage it as best you can to put yourself in the best possible position for when you need access to credit.

Table of Contents

Your Free Credit Report In South Africa

You are entitled to one free credit report a year from each of the credit bureaus. The problem is that very few people are interested in their credit report. Your credit report is just list of all of the information that they have on file about you and your spending and credit habits.

The thing is you already know this information. The debit orders are there to remind you the whole time and if one doesn’t go through, the R100 that FNB will charge you for a reversal will ensure that you know that it did not go through.

Are You Creditworthy?

What most of us want to know when we consult the credit bureaus is whether things are looking good or bad for us. They know this and this is why they give you a report of information that you already know because they are legally required to do so. Where they get you is that they give you the credit report, which doesn’t mean much to you without the credit score, and then they charge you R80 for your credit score, the thing you were actually looking for.

Related Article: How To Get A Home Loan When Self-Employed

What Does A Credit Score Mean?

Now firstly, we need to look at what the point of a credit score and what it means. Essentially, a credit score is just an arbitrary number that they attach to your credit behaviour, that classes you into 5 bands. These five bands can go by different names depending on whose scorecard you read, but essentially, they are Excellent, Good, Fair, Bad and Poor. They are all graded based on the risk that you pose to the lender as follows:

Excellent (Minimum Risk)

Good (Low Risk)

Fair (Average Risk)

Poor (High Risk)

Bad (Very High Risk)

Credit Score Is Not Important

What your actual score is does not matter. What determines your credit status, how a lender perceives you in terms of risk, is where you fit in these five bands. The credit score is just a scoring system that each of the credit bureaus devises internally to tell you where you fit in the range. That is why all their scores are different and out of unusual number like 705, 850 or 999.

The reason for this is that if they all used the same scoring system, say out of 1000 then once you or the entity that you are trying to borrow from have received your score from one bureau, you would no longer need to get your score from another bureau. For the most part, your score would be the same wherever you query because they all have and use the same information to calculate our score.

In short, the number on your credit score does not matter. What matters is the risk profile that you fit in. That is what determines whether the banks decide whether are creditworthy, and to what extent.

Get Your Free Credit Score In South Arica

Thanks to technology companies can now make money in innovative ways that. One of these is through online marketing. Your attention is worth money to marketing companies and they user various ways to entice you to give them that attention. You can now get your credit score for free from different companies in exchange for being a potential customer or signing up to specific platforms.

Related Article: How To Get A Home Loan Without Permanent Employment

Free Credit Score from Clearscore

ClearScore is a financial technology company from the UK. It was established in 2015 and their business is to give customers free access to their credit scores and reports.

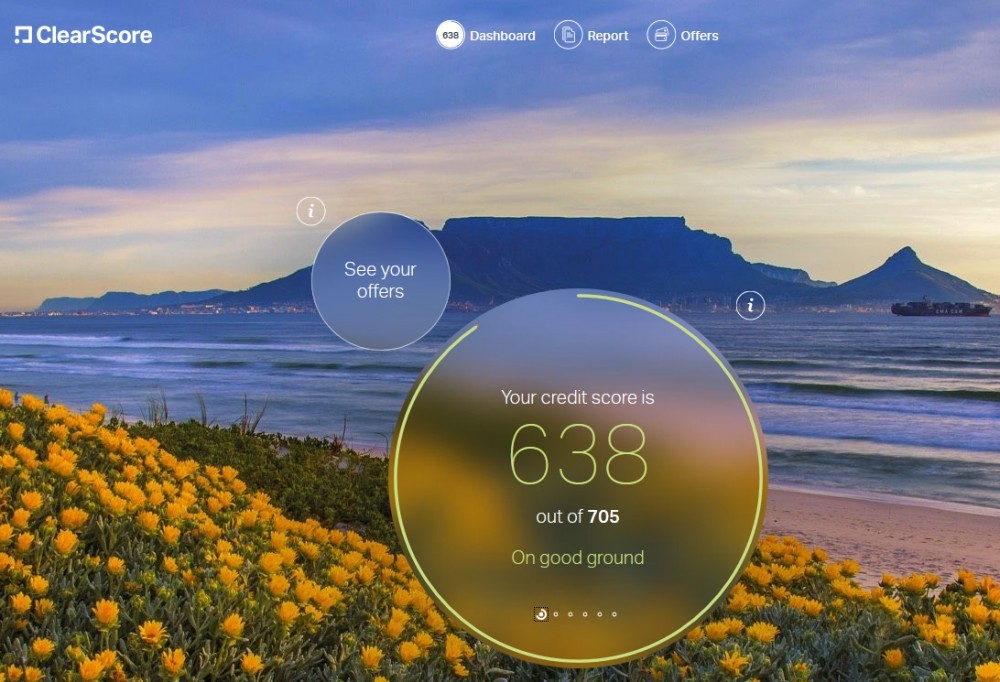

They now offer everybody in South Africa free access to their credit score. All you need to do is sign up on their website, unique personal details and once the process is completed they give you your credit score. The credit score that ClearScore gives you is your credit score with Experian. Experian is one of the main credit bureaus in South Africa, along with TransUnion, Compuscan and XDS.

If you want to know more about ClearScore’s platform before signing up, read our review on their platform.

The Score that they give you is out of 705 and appears to follow the Compuscan score bands which are as follows:

605 or less = Very High Risk

606 – 621 = High Risk

622 – 641 = Average Risk

642 – 667 = Low Risk

667 or more = Minimum

I personally love using ClearScore because of the great user interface, Not that it has anything to do with your score or creditworthiness, but the images that they use great visual aspects and images on the interface, which make for a great user experience.

Free Credit Status From FNB

FNB has recently introduced a new feature for its online banking app, called “nav”. It is a short for nav-igate and according to FNB is a collection of “Smart solutions to help steer you in the right direction”.

Among these solutions is one called nav>>money which as a feature called “Credit status”. Credit status is the result of an analysis by FNB that determines your credit-worthiness. They assess various data, including credit bureau information, to show you how fit for credit you are on a scale that. While the scale does not give you a score in the form a number, it is divided into 5 colour bands that pretty much represent the bands described above.

According to FNB, your status reflects your credit behaviour over a two-year history and is rated across seven credit indicators, displaying your strengths and weaknesses.

An additional feature that is pretty neat hat comes with the credit status is they tell you from within the app, which loan products that you qualify for. So if you were looking into your credit status because you are interested in buying a house, the app will tell you whether you qualify for one.

Credit score does not guarantee you a loan if excellent and a score that is not excellent or good does not necessarily preclude you from access to credit. The final decision to grant credit is at the discretion of the lender based on their own review systems and in accordance with the relevant regulations that they adhere to.

For more information on the FNB Online Banking App and the other nav features, check out our article on the FNB App.

Conclusion

In the US, for example, there are more than 10 different companies that you can consult to get your free credit score. In South Africa, the first company to give us access to Free credit scores was ClearScore. They showed up in 2017 and only one year later FNB introduced Nav Money where you can get your credit status for free through their app. We can expect more companies to introduce similar features as well in the near future and paying for a credit score from any of the credit bureaus will be a thing of the past.

Did you find this article helpful? Feel free to leave your opinion and any questions in the comments below.