Debt review inquiries in South Africa rose by a whopping 30% in 2021, as South Africans have found themselves swamped with more debt than they can handle and need professional help to manage their debt repayments.

Table of Contents

Rising Debt in South Africa and Debt Review

But why are so many South Africans— 67 percent to be precise— in debt? One of the main reasons is that today’s society is biased towards overspending. It has become the norm for credit providers to entice us with large sums of seemingly no strings attached money, enabling us to live dangerously above their means. The combination of poor financial literacy, unethical lending to risky clients, and extravagant spending habits has landed millions of South Africans in debt, with household debt in South Africa exceeding 44% of the national GDP in 2021.

That being said, not everyone with debt are guilty of trying to ‘keep up with the Joneses’. You might have fallen into debt while simply trying to survive. Unforeseen circumstances like sudden unemployment, losing the primary breadwinner in the family, and expensive medical emergencies put hardworking people in desperate situations in which the only way to stay afloat is to take a loan. And this decade, the world was hit by a global pandemic— inarguably the most unprecedented unforeseen circumstance in our history.

While credit is an important financial resource during hard times, if you use too much credit and do not pay back your debt promptly, you may find yourself in an exhausting battle with creditors— living with the constant stress that they could seize your assets at any moment.

Fortunately, there are resources to support you as you pay off your debts. One such resource is debt review. In this article, we provide a comprehensive guide to debt review. By the end, you will be confident enough to begin the debt review process and regain control of your finances.

Related: 9 Best Debt Review CompaniesWhat is Debt Review

Debt review, also known as debt counselling, is a formal debt relief process that helps consumers who are struggling to support themselves while paying off their credit debt to meet their debt obligations.

Debt reviewers communicate directly with their clients’ creditors to renegotiate repayment terms and reduce interest rates to establish a more manageable and structured payment plan for their clients.

Debt review formally came into effect in 2007, when the National Credit Act 34 of 2005 replaced the Usury Act (73 of 1968) and the Credit Agreements Act (75 of 1980). The preceding acts did not effectively protect South African consumers from unjust credit systems; several households spent prior to the National Credit Act, households could spend up to 84 percent of gross income on debt repayment.

The National Credit Act is very comprehensive, covering a diverse range of creditors from banks to micro-lenders, and other enterprises that offer credit. The Act also established other protective policies, like requiring banks to perform a thorough credit assessment prior to initiating new credit agreements, to ensure that consumers have the financial collateral to pay off credit without spiralling into a financial crisis.

In addition, the Act established consumers rights to apply for credit without unjust discrimination, and to receive transparent and understandable information regarding credit.

Debt review was not positively received by financial institutions, as it prevents them from repossessing indebted consumers property. However, debt review has successfully helped improve the economic well-being of thousands of South Africans.

How Does Debt Review Work

If you are struggling to pay all your basic living expenses such as food, transport, and utilities while keeping up with your debt repayments, you could potentially be over-indebted, and you may be eligible for debt review.

If after reviewing your financial situation you conclude that your essential expenses exceed your income, you can apply for debt counselling by filling Form 16. In the form you will need to report your income, expenses, and debt information.

A National Credit Regulator (NRC) approved debt counsellor will review your information and determine if you legally qualify as over-indebted. If you qualify, the debt counsellor will develop a debt payment restructuring plan for you and send it to your creditors for approval.

Once you initiate the debt review application, and for the entire duration that you are under debt review, the credit bureau will put a flag on your credit profile to inform creditors that you are under debt review. During this time, you may not apply for more credit. While waiting for your application to be processed and during the negotiation process, you will be protected against repossession of assets and other legal action by your credit providers.

You will be cleared from debt review when you have paid off all debts according to the debt review restructuring plan. If you default on any payments while you are under debt review, your credit provider is allowed to terminate the debt review and pursue legal action against you.

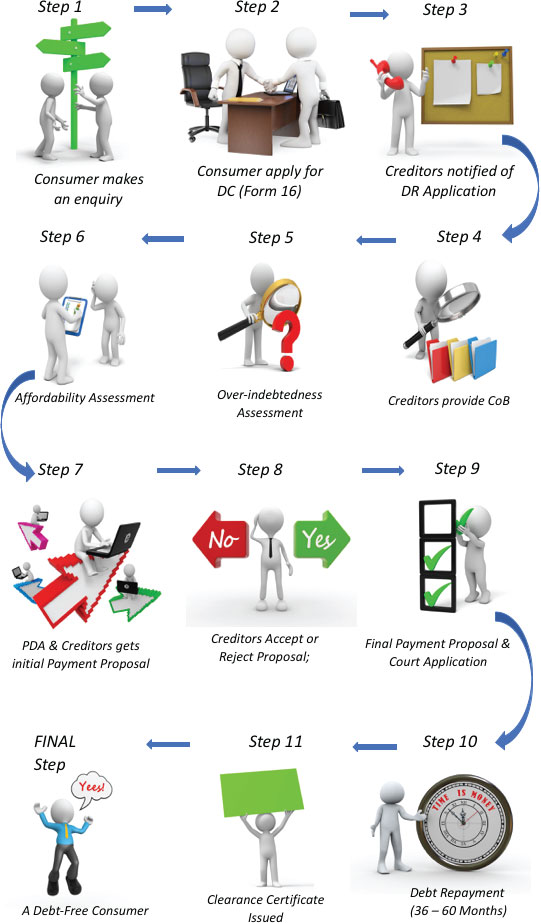

Debt Review Process

Step 1: Apply (lasts around 10 days)

- Fill out Form 16. Make sure you submit the necessary supporting documents; this usually includes your ID, three months’ worth of bank statements, and payslips. If you jointly own property with your spouse, you will need to apply for debt review together.

- Submit the application to a debt counsellor of your choice.

- Make sure you submit all supporting documents promptly and correctly, as the debt counsellors only have 60 days to complete the entire debt review process. If your application is not completed within the 60 days, it becomes void, and you will no longer have immunity against legal action from your creditors.

- Upon receiving your application, your debt counsellor will inform your creditors and credit bureaus of your application by submitting a Form 17.1 within 5 business days.

- Your credit providers will send your debt counsellor a Certificate of Balance with your latest financial information including relevant information such as your minimum monthly payment obligation, interest rate, and unpaid balance within 5 business days of receiving the Form 17.1.

- After receiving the Form 17.1, a credit bureau will put a flag on your credit profile to indicate that you are under debt review.

Step 2: Formal Assessment

- After receiving your Certificate of Balance from your credit providers, your debt counsellor will conduct a formal assessment to decide whether you are truly over-indebted and thus qualify for a debt restructuring plan.

- If the debt counsellor decides you are not genuinely over-indebted (if for example you have several non-essential expenses) then they will reject your application. At this point the debt review process is terminated, the debt review flag is removed from your credit profile, and you will no longer be entitled to the benefits of being under debt review.

- If your debt counsellor determines that you are indeed genuinely over-indebted, they will accept the application and inform yourself, your creditors, and the credit bureau via Form 17.2.

Step 3: Negotiation with Creditors

- The debt counsellor will develop a restructured debt repayment plan for you, taking into account both the amount of income you make and the amount of funds you need to cover your monthly basic expenses. When the restructured payment plan is complete, your debt counsellor will send it to your creditors for review.

- Your credit providers can a) propose a counteroffer, b) accept, or c) reject the restructured repayment plan proposal.

- If all your creditors accept the proposed restructuring plan, then your debt counsellor will send your case to the National Consumer Tribunal Court to provide a formal consent order to your credit providers, and the plan will go into effect.

- If any of your creditors reject the proposed repayment restructuring plan, your case will be referred to the Magistrate Court to determine the final ruling.

- If the Magistrate Court approves the payment restructuring plan, the debt counsellor will inform you and your creditors, and the plan will go into effect.

- If the Magistrate denies the payment restructuring plan, then the debt review process will be terminated, and you will no longer be entitled to the benefits of being under debt review.

Step 1 and step 2 have to be completed within 60 business days from receipt of your debt review application (Form 16). During this period, you are protected against repossession of assets and other legal action by credit providers.

Step 4: Implement Restructured Payment Plan

- Once your credit providers receive the formal consent order from the National Consumer Tribunal, or the court order from the Magistrate, they will have to restructure your credit payment schedule and interest accordingly.

- Under debt review, you can make credit repayments through a Payment Distribution Agent (PDA). You can also pay your credit providers directly.

- It is important to remember that debt review is not a debt repayment break. You will be expected to make every payment on time as indicated in your restructured payment plan.

- If you default on any payments, you risk being terminated from the debt review program, forfeiting all benefits.

Step 5: Final Clearance from Debt Review

- Once you have repaid all your debts according to the restructured repayment plan, you will be formally exited from the debt review program. Long-term debts such as home loan repayments do not need to be paid in full, however, they do need to be up to date and in line with the restructured payment plan for you to be cleared from the debt review program.

- Your debt counsellor will issue a Clearance Certificate and inform the credit bureau to lift the debt review flag from your credit profile. You will now be able to take out new credit again.

- Congratulations on being closer to financial freedom!

What are the pros and cons of debt review?

The advantages of debt review include the following:

- Financial Relief

While going into debt review does not cancel your debt, it reduces the amount of money you must pay back each month, giving you more time to pay off your debt and making sure you have enough money to support your basic needs in the meantime. In some cases, your debt counsellor may even negotiate reduced interest rates.

The relief is not only financial; knowing that your creditors won’t repossess your property or take legal action against you have a profound impact on your mental health, improving your overall well-being and productivity.

- Professional Mediator

Debt counsellors communicate and negotiate with your credit providers on your behalf. You will no longer need to deal directly with your credit providers. If your creditors do try to contact you, you can refer them to your debt counsellor. This provides a significant amount of relief, as it means no more dreaded reminders and threats from your credit providers.

- Expertise

Debt counsellors are well experienced and trained in financial management. They have the expertise and background knowledge to create highly effective repayment plans, and they possess the professional communication skills needed to negotiate with your creditors.

- Legal Protection

While under debt review, you are protected against legal action from your credit providers. In severe cases of over-indebtedness where you may be in danger of asset repossession at any moment, going under debt review can be the only way to save you your house, and other important assets.

- Centralized Payments

Keeping up with debt repayments can be a logistical nightmare, especially when you have to coordinate several different monthly payments at different times, to different creditors.

When you are under debt review you will have the choice of paying your debt repayments via a centralized payment system. If you owe money to several different creditors, the total sum of what you owe will be calculated and can be paid as single monthly payment to an approved Payment Distribution Agent. The Payment Distribution Agent will then pay all your creditors on your behalf.

- A Clean Slate

Once you complete your restructured payment plan you will be cleared from the debt review process. Your credit profile will be unflagged, and you will be eligible for credit again. This time you will have the peace of mind knowing that you do not have any outstanding debt.

- Financial Literacy

Several debt review service providers also provide financial education to teach you important tools and tips to help you manage your finances better in the future. You end up learning key financial concepts such as the difference between good and bad credit, how to form and stick to a budget, and how to build savings.

The disadvantages of debt review include the following:

- Freeze on Existing Credit Cards

While under debt review, you cannot use any of your existing credit cards. This is to prevent you from incurring more debt.

- No New Credit

While you are under debt review, you cannot take out more credit. In actual fact, this restriction is a way of protecting you from incurring more debt that you cannot pay back. Moreover, your debt counsellor will make sure you can cover your essential expenses by negotiating reduced debt repayments for you, so you shouldn’t need to take out more credit during the debt review process.

- Not All Accounts Eligible

If you have outstanding debt payments from that have already been subjected to legal action, debt review may not be able to include these accounts in the restructured repayment plan.

- Your Application Could be Rejected

If the debt counsellor or the court deems you are not genuinely over-indebted, they will reject your application for debt review. You will not be refunded your debt review application and any administration fees you paid upfront.

- It is difficult to exit voluntarily

While applying for debt review is entirely voluntary, exiting the program is not. You can only exit if your debt counsellor determines you have paid your debts in full, and that you are financially stable enough to pay any long-term debts like house loans. The only way to exit without your debt counsellor terminating the program for you, is to take your case to court with the hope that the court will deem you no longer over-indebted.

Now let’s take a look at some of the most common questions consumers have about debt review.

FAQ

Is It A Good Idea To Go Under Debt Review?

Yes, it is a good idea to go under debt review. At the end of the day, debt review is designed to protect your economic welfare. If you are eligible for debt review it means you have been formally deemed as over-indebted.

You may think you can handle your debt repayments on your own, but extreme cases of over-indebtedness require urgency, expertise, and a deep understanding of the credit system and legal policies surrounding it.

If you are struggling to cover your essential expenses because you are forced to spend too much of your income to repay your debt, trying to manage your debt on your own may lead to you taking out more credit you can’t afford. This can ultimately end up with you going into poverty or facing legal actions from your creditors.

How Long Does Debt Review Last

Most popular debt review service providers such as Debt Rescue, Debt Busters, and Debt Restruct report that on average, it takes clients 3 to 5 years to complete det review.

But how long you stay under debt review depends on a few factors such as the how much money you owe your creditors, your monthly repayment obligation, the amount of interest outlined in your restructured credit agreement, and your income during debt review.

Situations are unpredictable; if you find a higher paying job or get promoted while you are under debt review you may be able to pay off your re-negotiated payments sooner than the agreed upon end date.

On the other hand, if you default your debt payments, lose your primary income, or refuse to adjust your lifestyle, you risk extending the amount of time you are under debt review.

How Do I Remove My Name From Debt Review

Upon receiving your application for debt review, your debt counsellor will notify credit bureaus to flag your credit bureau profile, notifying them that you have applied for debt review.

This step takes place before the debt counsellor has determined whether you are indeed over-indebted or not. If you are not deemed over-indebted, the debt counsellor will request the credit bureaus to remove the flag. You are also free to cancel your debt review application anytime before your debt counsellor issues Form 17.2.

If you were successfully put under debt review, you will need to be issued a formal Clearance Certificate for your name to be unflagged and removed from debt review. You are entitled to receive a Clearance Certificate under the following conditions only:

- You paid all your debts in full according to the terms of your restructured credit agreement.

- For long term repayment agreements such as home loans, you need to show that you have the financial ability to pay future debt repayments according to the terms of your restructured credit agreement.

At the end or your debt review term, if you have paid your debts in full, the debt counsellor will suspend your debt review status and issue you a Clearance Certificate.

If you think you are eligible to be removed from debt review early (prior to receiving a Clearance Certificate from your debt counsellor), you can request termination of your debt review status.

You will need a court order issued by the Magistrate to rescind the original debt review order. To initiate the process, you or your debt counsellor will have to submit Form 17.W, along with copies of your original application documents (Form 16, Form 17.1, Form 17.2), letters of payment settlement from your creditors and account balances from any outstanding credit accounts.

If the Magistrate agrees that you no longer qualify as over-indebted, then you will be legally removed from debt review early and you will no longer be entitled to debt review benefits such as your restructured repayment plan and payment distribution agencies.

What Happens If You Don’t Pay Your Debt Review?

Being put under debt review does not relieve you from your debt repayment obligations. While debt review grants your more time to pay off your debts, you still need to pay them off in full and comply with your restructured repayment plan.

If you miss a debt review payment, there are serious consequences. You give your creditors grounds to terminate the restructured debt repayment agreement, which would restore your original pre-debt review repayment schedule and interest rates.

Defaulting on your debt review payments can also lead to creditors garnishing your wages and repossessing your assets such as your home or car.

That being said, there may be unforeseen circumstances that lead to you not having enough money to fulfil your debt review payment obligations. Unexpected job loss or medical emergencies are examples. It is important to contact your debt counsellor as soon as you suspect that you won’t be able to pay an upcoming instalment.

Your debt counsellor will assess your financial situation and attempt to renegotiate the terms of your debt repayment agreement, or request a payment pause from your creditors. Whether the creditors grant the extension is at their discretion, but typically, if you can show the creditors, you genuinely want to pay back your debts— such as providing proof that you are seeking new employment and paying as much as you can, even if it seems like nothing— they are more likely to renegotiate.

How Does Debt Review Affect You?

Debt review will provide you with more time to pay off your debts and protect you against legal action from your creditors when you are financially struggling. Debt review allows you to afford your essential, basic needs while honouring your debt obligations.

During the debt review process however, you will be restricted from using your current credit lines or from taking out new forms of credit. Debt review also erases your credit history, requiring you to rebuild your credit score from scratch. This may seem like an impossible task, but if you are disciplined and committed to the process, debt review can help you gain back control of your finances and build back your credit stronger than it was before.

Can I Pay My Creditors Directly While Under Debt Review?

When you are under debt review you are entitled to pay your creditors in one centralized payment through a Payment Distribution Agent.

However, if you wish to pay your creditors directly, you are permitted to do so.

Using a Payment Distribution Agent has certain benefits and is highly recommended. Your debt counsellor will be able to track your debt repayments independently when you use a PDA. If you pay your creditors directly, you will be fully responsible for keeping track of the payment schedule and you will have to send your debt counsellor proof of payment.

Can I Buy A House After Debt Review?

Yes, several people who have completed debt review go on to buy houses. Debt review does not blacklist you from home loans. Completing debt review successfully will restore your credit score to zero.

With a credit score of zero, you will be able to take out credit, but because you have no credit history, you will only be eligible for small loans. It may take a few years to rebuild your credit to a satisfactory level to be eligible for a home loan.

How Do I Get Out Of Debt Review Quickly?

Personal commitment to completing debt review is a key factor that determines how quickly you can get out of debt review.

If you really want to get out of debt review sooner, you can find resourceful ways to reduce your living expenses such as moving into a smaller space, selling non-essential assets, and resisting spending money on unnecessary material goods.

Generating additional income is also a good strategy to reduce the time you are on debt review. You can apply to a part time job. When you receive large sums of supplemental income such as a holiday bonus, you can direct this extra cash flow towards paying off your debts.

Paying off debt that has higher interest rates first will minimize the overall interest that you incur, helping you to pay off your debts quicker.

How Much Does It Cost To Remove Debt Review?

It costs nothing to cancel debt review before the Form 17.2 has been issued. Similarly, if you receive a Clearance Certificate from your debt counsellor, your debt review will be terminated automatically. The fee for the Clearance Certificate is included in the debt review service provider after-care fee (5% of the distributable or a maximum of R450, whichever is less).

If, however, you have already been approved for debt review by the Tribunal or Magistrate, the only way to cancel your debt review prematurely is through the court. You will be responsible for paying your legal fees, and this can be pricey depending on which lawyer you hire.

How Long After Debt Review Can You Buy A Car?

Debt review does not blacklist you from car loans. Completing debt review successfully will restore your credit score to zero.

You will be able to take out credit. However, your credit score is based on lending and repayment history. Because you have no credit history, you will only be eligible for small loans. If you maintain good credit, you can rebuild your credit to a satisfactory level to be eligible for a car loan, though it may take a few years.

Is It True That After 7 Years Your Credit Is Clear?

Yes. According to TransUnion and Experian, most negative credit information must be removed from your credit report eventually. Late payments and foreclosures remain on your report for 7 years from the date of occurrence, after that they are cleared. However, the only time your entire credit history is completely cleared is when you complete debt review successfully. When this happens, your credit will be reset to zero and will have to rebuild your credit history from scratch.

What Happens If I Lose My Job While Under Debt Review?

One of the eligibility requirements for debt review is that that you or your spouse need to have a stable source of income or employment. If you do not have a job, your debt counsellor cannot guarantee that you will be able to pay the renegotiated repayment.

But what happens if you lose your job while you are already under debt review? If you lose your job under debt review, you should report the change in your employment status to your debt counsellor immediately, along with proof of unemployment. Your debt counsellor will assess your financial situation and attempt to renegotiate the terms of your debt repayment, or request a payment pause from your creditors.

If you have credit insurance such as credit life or mortgage payment protection insurance, your insurance may be able to cover your credit payments for up to 6 months in the case of retrenchment or mother major life change that prevents you from being able to pay, such as disability or death of the primary bread winner.

The National Credit Act also provides support for unforeseen circumstances. It allows consumers to apply for a Payment Postponement Application which asks the court to issue an order that will allow the consumer to postpone payments for up to 6 months.

That being said, debt repayments cannot be paused long-term, and renegotiation is at the discretion of your creditors. You may need to sell some of your assets to keep up with your debt payments during unemployment and prevent yourself from being terminated from debt review altogether.

Focus on paying off high-priority debt like outstanding balances for car loans or utility bills, as these are essentials.

Can I Sell My House While Under Debt Review?

Yes, when you are under debt review, you can sell your house. Your focus during debt review should be on getting debt free. You should not sell large assets to free up money to fund unnecessary expenses. In addition, you should always consult your debt counsellor to discuss the implications of significant financial decisions such as deciding to sell your house.

Can You Be Blacklisted While Under Debt Review?

You cannot be blacklisted under debt review. True blacklisting in terms of credit is not a practice that occurs anymore. When you default on credit payments, your credit score decreases. The lower it is, the less chances you have of applying for loans successfully— this is what most people are referring to when they use the word blacklisting.

When you are put under debt review, your credit profile is flagged, this is simply to notify creditors that you are not permitted to take on new credit or use your current credit cards.

When you complete debt review successfully, your credit score goes back to zero. All records of being under debt review will be erased from your credit profile.

Most creditors view the decision to go under debt review as responsible, it demonstrates that you want to commit to paying off your debts and want to restore your credit. However, you are free to take out credit again.

The only case in which you can negatively impact your credit is if you default on payments. When this happens, you will be terminated from the debt review program and your poor credit history will not be erased.

Can I Apply For Debt Review Twice?

If you applied for debt review and you did not qualify as over-indebted, you can apply again in the future if you go through a life change that may make you eligible, such as a pay cut.

Regardless of if you have applied before, your debt counsellor will assess your financial situation and determine if your circumstance meets the requirements for over-indebtedness.

How Do I Know If My Name Is Under Debt Review?

If you are not sure whether your name is still under debt review, you can order a report from a credit bureau. If you are still flagged as being under review, that will be indicated on the front of the document. You are entitled to one free credit report once a year. After that you can request an additional report for a small fee.

What Is The Difference Between Debt Review And Debt Counselling?

Debt counselling is simply another term for debt review, but the process is exactly the same.The professional debt manager that works with you during the debt review process is called a debt counsellor.

Who Is The Best Debt Review Company In South Africa?

When choosing a debt review company, it is important to choose a reputable company. Your debt counsellor will be negotiating your credit agreement on your behalf and will achieve the best outcome if they have a good rapport with creditors and have your best interests as a priority.

You should only go to a debt review company that is registered by the National Credit Act. The NCR has a full list of registered counsellors and companies on their website. Some of the most popular debt review companies include Debt Rescue, Debt Busters, National Debt Advisors, and National Debt Counsellors.

Can I Get A Loan While I Am Under Debt Review?

No, while you are under debt review you cannot take out new credit. The purpose of debt review is to enable you to pay off your debts. Allowing you to incur more debt would be counterproductive. When you are successfully exited from debt review, your debt counsellor will instruct the credit bureau to remove your debt review flag and you will be allowed to take out new credit again.

Does Debt Counselling Affect Your Credit Score?

Many people delay applying for debt review because of the common misconception that debt review can negatively affect their credit score. The fact is debt review will not hurt your credit score. The intention of debt review is to provide you with a clean slate to help you get on track to financial freedom.

Once you complete debt review successfully, you will be cleared from the debt review program and your debt review status will be removed from your credit profile. At this point, your credit score will be restored to zero— this essentially erases your credit history. You will once again be able to take out credit, but because you have no credit history, you will only be eligible for small loans such as cell phone and insurance accounts. As you rebuild your credit and strengthen your credit score, you will become more eligible for larger loans like credit cards, car loans, or house loans.

The Bottom Line

Debt review can be a vital tool to help you survive if you are over-indebted. But it requires a tremendous amount of discipline and commitment. If you commit yourself to paying off your debts, you will be on track to gaining back control of your life, and your hard work and sacrifices will pay off.

Please give me a email adress to request a report from credit bureau.

What report are you looking for? If you are looking for a full credit report, you can simply google credit report and there will be several options such as Experian, Transunion etc where you can request a full credit report from. There might be a cost to it, though.

If you want to be able to check your credit score for frequently for free, you can sign up to ClearScore. If you create an account there, you can get your Experian credit score that you can access at any month and they will also send you a monthly report that will reflect any changes in your credit profile.

Can you travel internationally whilst under debt review.

Can I apply for debt review twice?