Welcome to our Debt Busters Review. If you are reading this, it is probably because you are looking for a debt counselling company due to financial strain. In this article, we will explain how Debt Busters works, what their reputation with clients is, and whether they are a good company to go with.

Table of Contents

Debt Busters Review Summary

Debt Busters is an established debt review company based in Cape Town. They have a have a nationwide footprint and have helped numerous clients out of debt. They are one of the leading debt counsellors in South Africa along with other companies like Debt Rescue. While there are some bad experiences reported by clients who have gone under debt review with them, the overall reputation of Debt Busters is that of a good company. Negotiators at DebtBusters have reduced clients’ interest rates from 21% to 3% on average and if you are looking into debt review, they are one of the companies worth considering.

Related: 9 Best Debt Review CompaniesWhat is DebtBusters?

Founded in April 2004, DebtBusters is a part of the IDM Group (Intelligent Debt Management). Located in central Cape Town, Debt busters has established itself as the leading debt management company in South Africa. DebtBusters holds many accolades and achievements, such as winning the Best National Debt Counsellor from the annual industry Debt Review Award for 2014, 2016, 2017, 2018, and 2019 and The Star Newspaper Readers’ Choice Award in 2018 and 2019.

With over 400 dedicated employees, DebtBusters endeavours to provide solutions to financially challenged and over-indebted South African clients. The proof of this company’s commitment to its clients is evident in the more than 150 000 customers assisted throughout all provinces in South Africa. Their expert counsellors assist in negotiating new interest rates and have successfully reduced interest rates from 21% to 3% on average. This has saved their clients over R450 million in interest.

DebtBusters is in the business of assisting South Africans who need a chance to recover from bad financial decisions. Their employees are constantly developed to keep up with the latest laws and innovations, which gives them the advantage when approaching each client’s individual needs. DebtBusters offers a host of services besides debt counselling; other available services are debt consolidation, credit report, credit repair, debt settlement, insurance reviews, financial planning and financial education.

Debt counselling is a process that has been documented in South African credit law. Consumers overwhelmed with debt receive assistance from a debt counsellor who negotiates with creditors to lower interest rates and reduce monthly payments. DebtBusters is a debt management company with over 18 years in the industry and is currently striving to improve the financial situation of over-indebted consumers. Stressed consumers who are failing to meet payment requirements are now turning to debt counselling to help them overcome the current financial strain. DebtBusters has set out to lighten the load by offering highly trained employees who make clients feel secure that they are making the right decision when choosing their company to assist.

How does DebtBusters work?

Finding a healthy solution to getting your finances back on track is not always easy, and trying to do this task on your own may prove to be even more challenging. DebtBusters works hand in hand with South Africans to make this a smooth and stress-free situation with their easy to follow process. Here is how the process works.

Step 1

At this stage, you have either made up your mind to get debt counselling, or you still need more information. Either way, what you should do at this point is contact DebtBusters. You can do so by calling them or by filling out the online inquiry form. A consultant will be in contact with you soon after. DebtBusters consultants are well trained in explaining how the debt review process will work. They will take time to assess your financial situation and then advise you on the process and how they will help you get back to a healthy financial situation. Once you are happy with the information supplied, the consultant will send you the application form and will indicate the documents you need to attach.

Step 2

When DebtBusters receives your application, they will assess your income and expenses to determine if you are over-indebted. If you are over-indebted, you will move on to the next step; if not, they will advise on other ways to manage your debt.

Step 3

In this step, your debt counsellor will notify the National Credit Regulator (NCR), your creditors, and the credit bureaus that you are now under debt review. This will prevent any legal action from being taken against you.

Step 4

Once the necessary parties have been notified, your debt counsellor will help you draw up a budget that works for your household. They will advise on areas of your budget where you can effectively save more and pay off debt faster.

Step 5

DebtBusters will now follow up with creditors about information regarding your account. They will need to supply information on monthly instalments, interest rates and outstanding balances. Your creditors will also need to inform them if they have taken any legal action against you. All this information is used to update your DebtBusters profile and further confirm you are over-indebted.

Step 6

Your new budget will be sent to you, indicating the breakdown of your payment schedule and the total amount you need to make available to creditors. You will then be required to make one payment to a Debtbusters chosen NCR registered Payment Distribution Agency. A Payment Distribution Agency (PDA) obtains payments from debt counselling clients and then disburses the funds to the clients’ credit providers.

Step 7

Each creditor will receive a copy of your proposed budget schedule. This is so that they better understand your repayment plan and how much and when they will be receiving payment. DebtBusters uses DCRS and Pro-Rata systems to calculate how much each creditor gets paid.

Step 8

This step requires your credit providers to accept or reject your proposal. If some of your creditors reject the proposal, DebtBusters negotiators will try to negotiate further with these creditors to find an amount that works for both of you. If they disagree, the matter will be taken to court for a magistrate to decide.

Step 9

You will make your monthly payment to the agreed-upon Payment Distribution Agency. Your budget will be reviewed every year by DebtBusters.

Step 10

In this final step, a Clearance Certificate will be issued to you once all your debts have been paid. You will then send this to your creditors, the NCR and the credit bureaus to clear your credit record.

Related Article: Comprehensive Debt Review Guide

Pros

- You will work with a debt counselling company that has proven results of reducing interest rates from 21% to 3% on average.

- Quick and efficient service from consultants

- Services are available in all South African provinces.

- Debt counselling will free up cashflow making it easier to afford day to day expenses

Cons

- As a result of paying smaller sums each month, your debt may take longer to pay off.

- You will pay more for your debt due to the additional debt counselling fees.

- You will not be able to acquire any more debt until the debt review process is over.

Debt Busters Reviews

While Debt Busters records of over 150 000 clients helped highlight their service, the online reviews also attest to the excellent customer service. Clients have highlighted the speed with which Debt Busters responds to online inquiries and how letters are sent out to creditors within 24 hours. Another client commented on how seamless and efficient the process had been from start to finish expressing that DebtBusters are undoubtedly the best debt counsellors. Most have expressed the relief that DebtBusters has brought to their lives by having a payment plan that reduces their stress incredibly.

Clients praise the consultants for their helpful, friendly and professional service. Advice given by consultants has helped clients feel more hopeful about their situation and ended the neverending debt cycle for some. The results of debt counselling done by Debt Busters have offered clients the opportunity to give more back to their families, like spoiling their kids again, something they were not able to do while being over-indebted. A client was so thrilled with the results of her debt review. It now allows her to build her mother a house.

While most reviews about Debt Busters have been positive, a few clients have not had such a positive experience. Reviews online by unhappy customers expressed their frustration about trying to obtain a Clearance Certificate when the process was done. Like in any business, DebtBusters has experienced reviews about consultants that were not so helpful. These reviews have mentioned specific consultants, which do not take away from the consultants who have provided excellent customer service. The overall dissatisfaction with consultants seems to be due to them not returning calls or emails, not providing correct information and not attending to aftercare queries. Some have also highlighted the balance differences between the client portal and what creditors have on their system, indicating that Debt Busters does not update balances regularly on their client portal.

What is better than Debt Busters?

There are only a few debt review companies in South Africa that are at the scale of Debt Busters. Examples of these are Debt Rescue and National Debt Advisors. These are the companies that have been around for 10 years or more, and have a long track record with helping clients. Debt Busters is headquartered in Cape Town, while NDA is in Durban. They are all good and have furnished a lot of info that clarifies debt review.

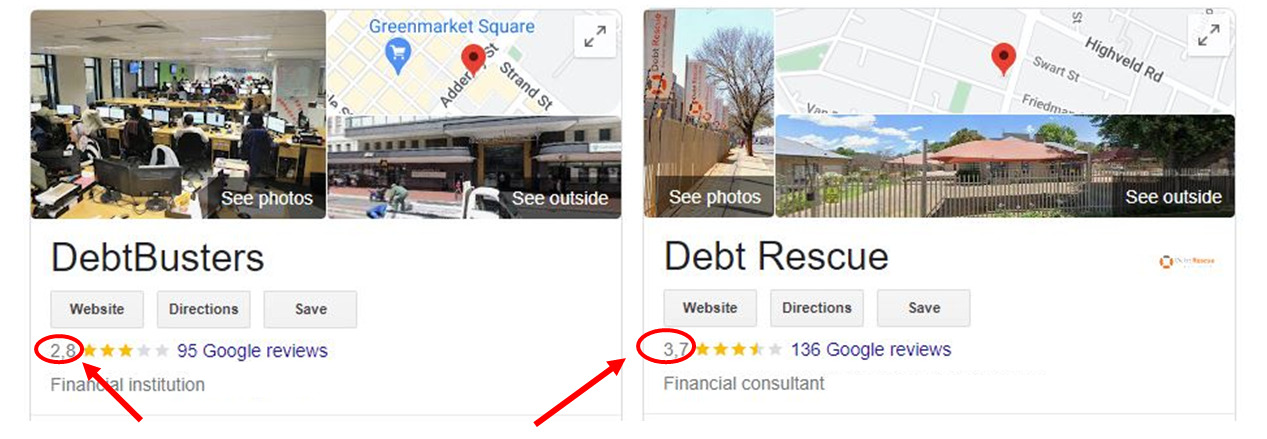

But the in terms of overall reviews, Debt Rescue has the best track record of all of them. They have a better overall scores and from considerable more reviews than Debt Busters

They also have a national footprint and are consulted by national news, which is a testament to their reputation. So if you are on the fence on which one to go with, you can use that information to aid in your choice. Each company has its fair share of positive and negative reviews so the ultimate decision will depend on which one you think personally appeals to you the most.

Conclusion

The conclusion of our Debt Busters review is that they are a reputable company with a track record of having helped people out of debt. Like any other company, there are report of clients with both good and bad experiences, but the overall results are on the positive side. If you want an alternative with better online reviews, then as mentioned before, you can look at Debt Rescue instead which has a Google Review average of 3.75 out of 5 versus the 2.8 out of 5 for Debt Busters.

South African consumers struggling with debt are hesitant to seek financial assistance because they are embarrassed or are unaware of the measures they can take to repair the situation. If money worries are keeping you awake at night, give a debt counsellor a call. Their debt counsellors will walk you through the process, helping you prioritize your payments and build an action plan for getting back to financial health.

Next Article: Top Debt Review Companies in South Africa

DO YOU HELP PEOPLE UNDRER DEBT REVIEW AND HOW

We are not a debt counselling company. Here is a list of companies that you can get in touch with if you need debt counselling. Any one of them will provide you with the information you need on how they help indebted people. https://onlinebusinessguide.co.za/debt-review-companies-in-south-africa/